After Philadelphia suffered from five straight decades of declining population, bottoming-out at 1.49 million in 2006, the city has since faced steady annual growth. [1]

The city’s population growth has been fueled by Millennials, young families, and immigrants. Upwardly mobile new neighbors are buying lower-cost homes, which is causing gentrification – for this research report: a socio-economic restructuring that pushes out working-class residents.

While gentrification is impacting many neighborhoods, not all are being impacted at the same rate. Gentrification is also driving citywide income inequality. [2]

This research report seeks to answer three key questions:

1. Where have Philadelphia’s Census Tracts gentrified?

2. What are the characteristics of gentrified Census Tracts?

3. What is the impact of historic “redlining” on gentrified Census Tracts?

I. Introduction: The Federal Government Graded Neighborhoods for Perceived Home Loan Risk in the 1930s

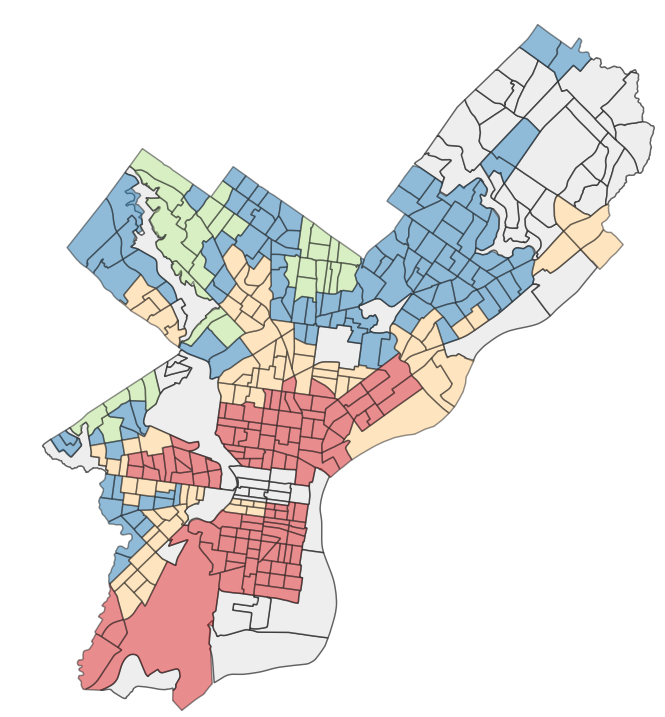

(Above) The 1937 HOLC Philadelphia map, via Hidden City Philadelphia.

In the 1930s, the federal New Deal established the Home Owners’ Loan Corporation (HOLC) to stem foreclosures.

The HOLC graded cities for their perceived risk of paying back home loans, from “Best” in green, to “Hazardous” in red. Neighborhoods outlined in red are called “redlined.”

The HOLC took into account a variety of factors, including race – with lower grades for Black, Italian, or Jewish neighborhoods. In 1937, the HOLC created Philadelphia’s map (right), with the “ethnic” neighborhoods of South, Southwest, and North Philadelphia all being “redlined.”

Redlined neighborhoods became segregated by race and class, and could not get mortgages, or create generational wealth. With the G.I. Bill prioritizing home loans to White WWII veterans, and changing racial attitudes that Italians and Jews were white, the maps would presage “White flight” to the Northeast and suburbs from the 1950s onwards. [3]

II. Background on Gentrification

(Above) Philadelphia’s Society Hill was a model of “hyper-gentrification” in the 1960s, via Philadelphia Inquirer and Temple University Urban Archive.

Gentrification was first coined in 1960s London, when wealthy newcomers bought run-down mews and cottages and large Victorian houses, pushing out poor and working-class residents. [2]

In the United States, redlining, racial convenants, “block busting” (selling houses when non-White residents moved in), deindustrialization, and urban renewal caused Black and Latino inner-city neighborhoods to hollow-out in the 1950s-1970s. These processes, along with “White flight” to newly-built suburbs in the 1950s, set the stage for gentrification from the 1970s. [2]

Worldwide, gentrification accelerated in the 1990s. Qualitative accounts often frame gentrification as a negative – White, middle-and-upper class, newcomers push out lower-income minority residents, [4] and “there goes the neighborhood.”

However, studies of gentrification in Philadelphia and nationwide show that gentrification tends to happen in majority White neighborhoods, and does not displace the original residents. Gentrifying neighborhoods have lower crime and poverty rates, better educational opportunities, and more racial integration. [2, 4, 5]

In fact, the negative effects of gentrification on the neighborhood level may even be overstated. However, gentrification does drive city-wide income inequality, resulting in fewer lower-income neighborhoods, and driving an increase in poorer suburbs. [2, 4, 5]

III. Background on Philadelphia’s Gentrification

(Above) Artist’s rendering of the proposed North Station District at Broad Street and Indiana Avenue, in the once-redlined, now-gentrifying North Philadelphia neighborhood, via Spagnolo Group Architecture and Philadelphia Inquirer.

Philadelphia’s decline left many neighborhoods with high vacancy and poverty. The city was primed for redevelopment.

In Philadelphia, gentrification has accelerated since 2000, largely because of property tax abatements, Center City’s growth, and the expansion of university anchors in North Philadelphia (Temple University) and West Philadelphia (the University of Pennsylvania and Drexel University).

In a study of 50,000 Philadelphia adults, residents from gentrifying, non-Black, Census Tracts moved up. Middle-class homeowners sold their homes and moved to the suburbs or to another gentrifying neighborhood. Lower-income homeowners remained, as their neighborhood improved.

Middle-income renters stayed, with rents increasing by only $50-$126/month. There is debate on the fate of lower-income renters, who moved to equal or worse-quality neighborhoods.

Black, lower-income renters fared the worst: moving to lower-quality, non-gentrifying Census Tracts in the city or the suburbs. Fewer low-income neighborhoods remain. [4, 5]

IV. Data and Methods #1: HOLC Redlining Scores

HOLC data are from the University of Michigan’s Institute for Social Research and the National Community Reinvestment Coalition. [6] They mapped the HOLC’s grades onto current Census Tracts. The HOLC did not grade all of the neighborhoods at the time, some, such as the Far Northeast or deep South Philadelphia, were not built.

As some Census Tracts covered multiple original mapping areas, I’ve adjusted the grades to better reflect the new values: Best (Green, 1.00-1.99), Still Desirable (Blue, 2.00-2.99), Declining (Orange, 3.00-3.99), and Hazardous (Red, 4.00). Center City (in gray) either was not graded at the time, or the researchers are still working on digitizing the grades.

IV. Data and Methods #2: Gentrification Index

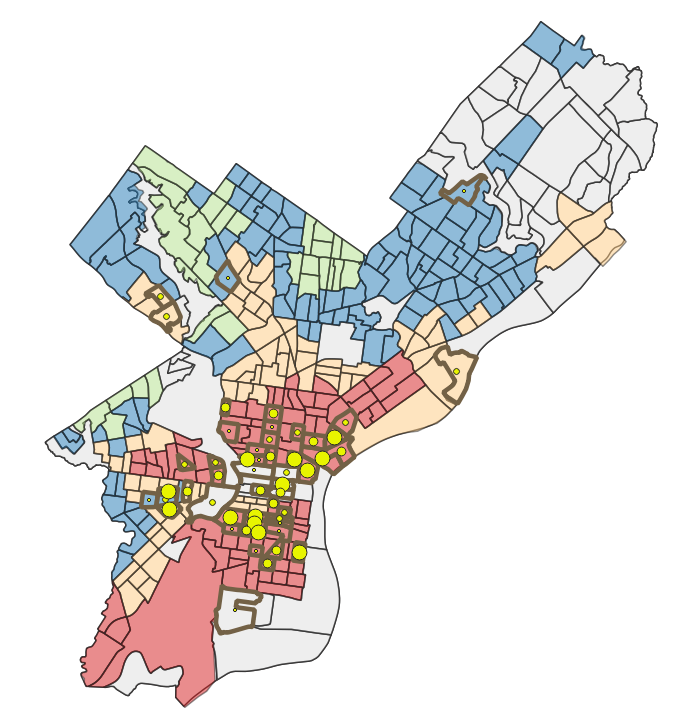

The Philadelphia Gentrification Index is calculated by Temple University – Geography and Urban Studies doctoral student Daniel Weise, who based the Census Tract-level index on a study of New York’s gentrification. [2] The Index is calculated from three variables for 2010-2015 (below). I then created Centroids for each of the Census Tracts, and created Graduated Circles for their values. The Census Tracts are outlined for ease of viewing.

1. Increase in Educational Attainment

A proxy for residents who have or have the potential to become high-income earners. Some studies use median rent or home values.

2. Increase from Renter-Occupied Housing Units to Owner-Occupied Housing Units

As gentrification increases, new owners change multi-family residences into single family homes, convert industrial lofts to upscale apartments, or convert co-ops or affordable housing to luxury condominiums.

3. Increase in Neighborhood Newcomers

Gentrifying neighborhoods have a higher number of residents who moved in the last 10 years. However, this may also capture lower-income residents who are displaced from gentrifying neighborhoods. Some Census Tracts that had positive gentrification values were removed upon further inspection of the neighborhood characteristics.

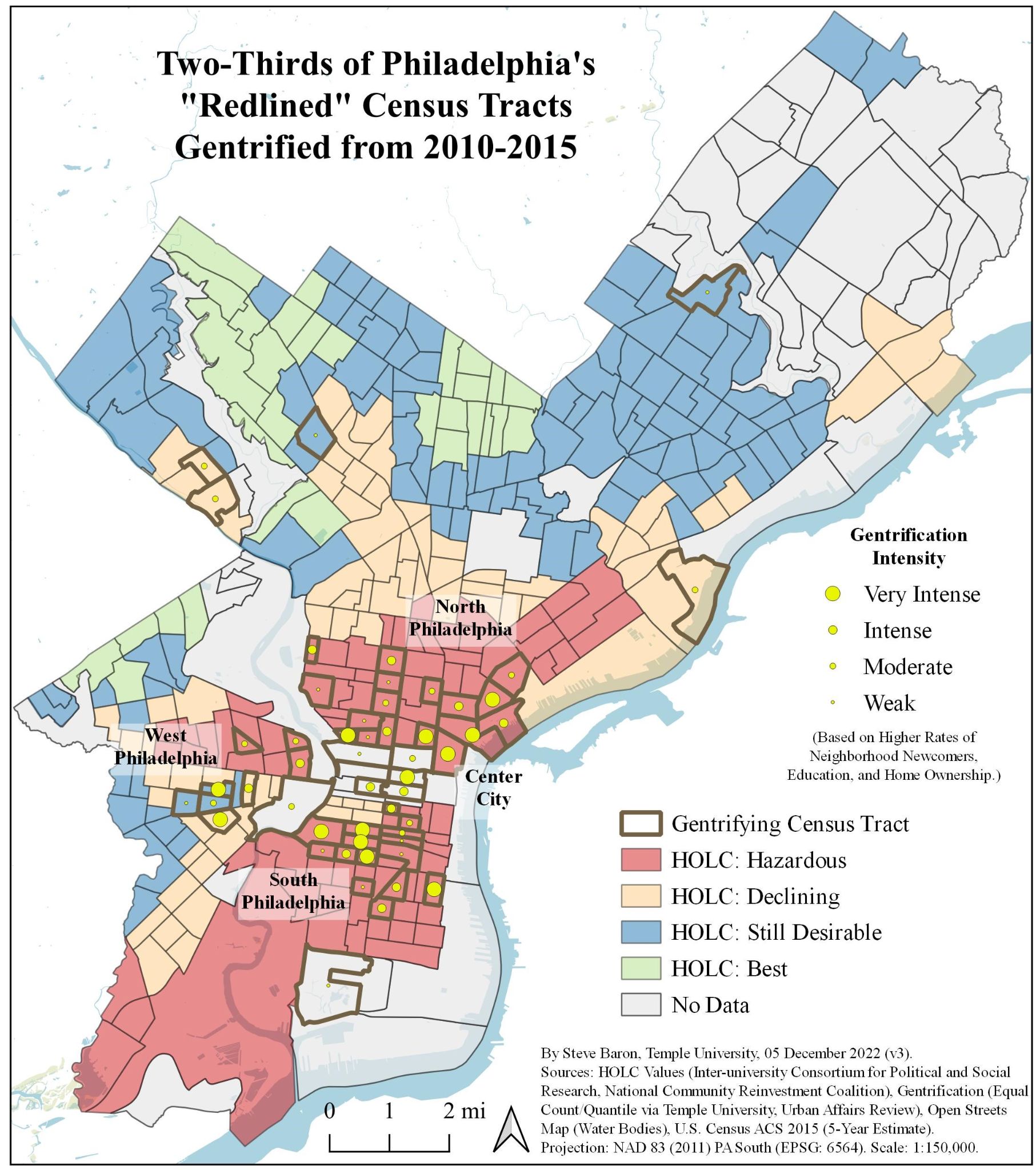

IV. Data and Methods #3: Gentrification Index

Overall, Philadelphia had only 52 out of 384 Census Tracts (13%) that gentrified in 2010-2015. The Gentrification Index values range from 3.72 to 37.07, which have since been re-scaled to four Gentrification Intensity grades by Equal Count (Quantile): “Very Intense” (13.7-37.1), “Intense” (9.1-13.7), “Moderate” (5.5-9.1), “Weak” (3.7-5.5).

As the original data were not included in the Gentrification Index, I’ve created charts of Neighborhood Newcomers, Education, and Home Ownership rates based on analysis of the U.S. Census 2015 ACS (5-Year Estimate). [7]

I’ve calculated the averages of the values for the four types of U.S. Census Tracts:

1) Gentrified and redlined, 2) Gentrified and not redlined, 3) Not gentrified and redlined, 4) Not gentrified and not redlined

V. Results #1: More Neighborhood Newcomers

Neighborhood Newcomers, based on the average rate of the year in which residents moved into their housing unit, appears to be a stronger indicator of gentrification than home ownership.

Gentrified Census Tracts had more recent Neighborhood Newcomers. Gentrified but not redlined Census Tracts saw the most recent move-ins, with 2011 for renters and 2001 for homeowners.

Gentrified and redlined Census Tracts saw the second most recent move-ins, at 2011 for renters, and 2000 for homeowners. Not gentrified Census Tracts saw the same average year for move-ins regardless of redlining, at 2010 for renters and 1996 for homeowners.

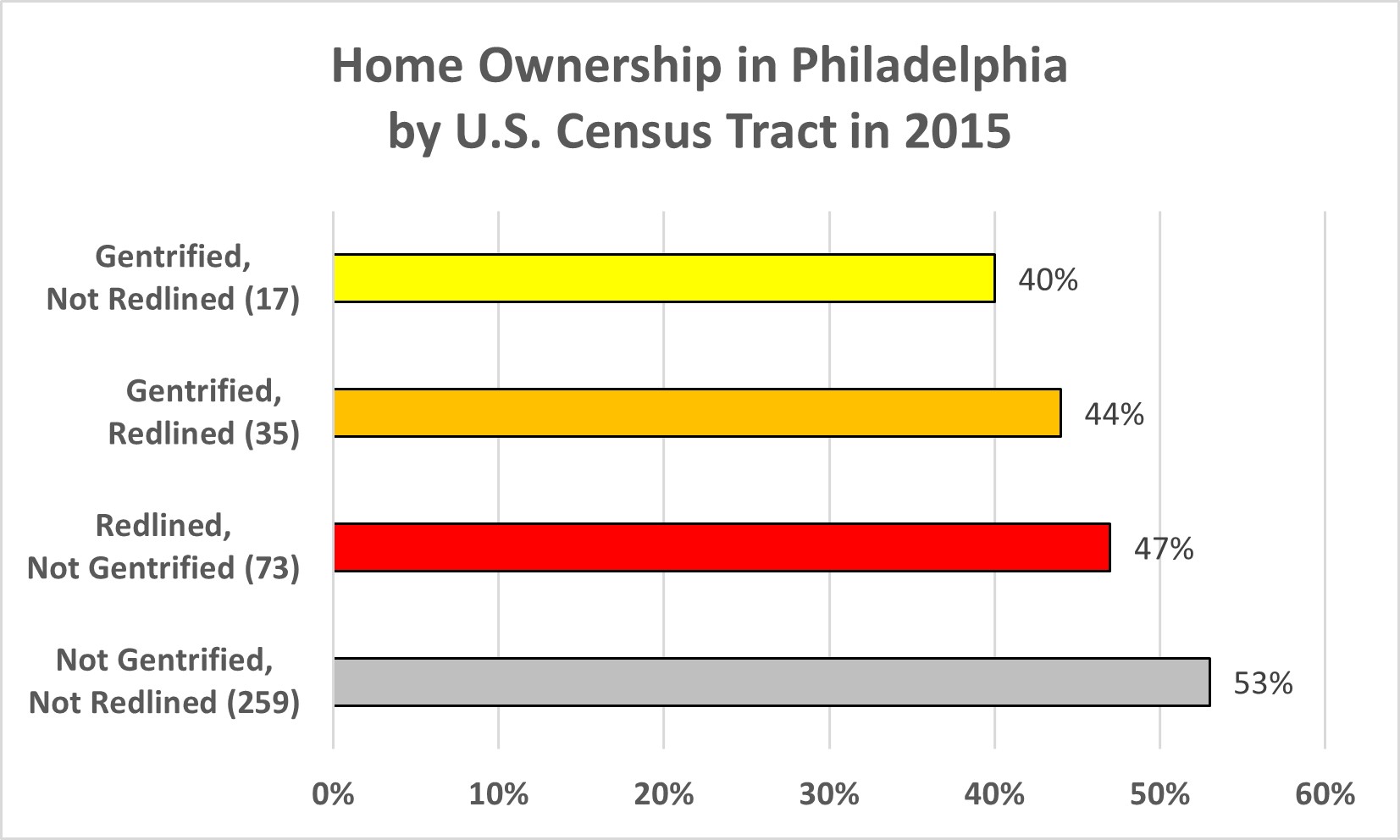

V. Results #2: Home Ownership Remains High

Despite the literature positing that gentrified neighborhoods have higher rates of ownership, the reverse actually appears here: Gentrified Census Tracts have the lowest rates of home ownership (40% for not redlined, 44% for redlined). Not gentrified and not redlined Census Tracts have the highest rate (53%).

Still, Philadelphia has long been a city of homeowners. [4] In 2015, half (50%) of the city’s homes were owner-occupied, and 48% were rentals. Even in redlined, but not gentrified Census Tracts, home ownership is at 44%. [3]

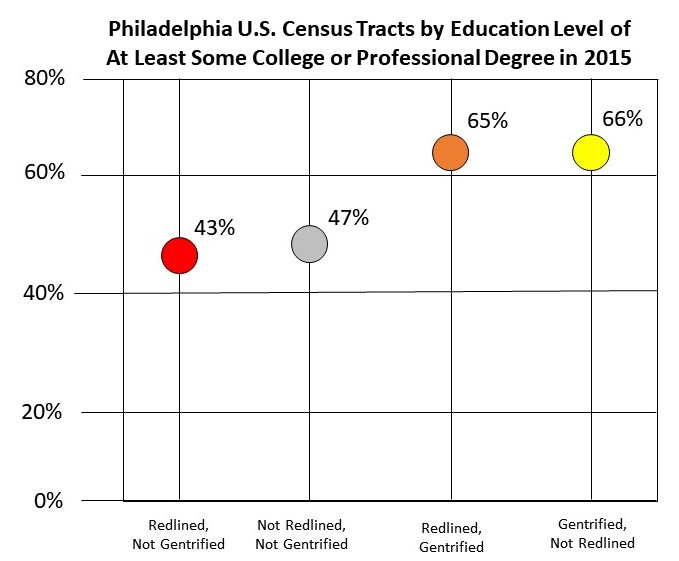

V. Results #3: Educational Levels Rise Amid Gentrification

Gentrified Census Tracts are seeing higher levels of educational achievement.

About two-thirds of residents in gentrified Census Tracts (66% in not redlined, 65% in redlined) have at least some level of college education. Citywide, the average is 50% of residents are high school graduates or less, while 48% of residents have at least some college experience.

Residents in Census Tracts that are not gentrified or redlined are below those levels, at only 47%. Residents in redlined but not gentrified Census Tracts fare the worst, with only 43% having at least some college education.

VI. Conclusion: Overall Redlining vs Gentrification

Two-thirds of Philadelphia’s gentrifying Census Tracts (35 of 52, 67%) were “redlined,” especially in North, South, and West Philadelphia. Gentrified Census Tracts have higher rates of neighborhood newcomers (homeowners and renters), and higher levels of educational achievement. However, gentrified Census Tracts do not have higher home ownership rates. This may be a result of the City’s unusually high homeownership rates compared to American cities.

Statistical analysis paints a more complex picture. A t-test reveals a p value of < 0.0001. This means that redlining and gentrification values do have a statistically significant correlation. However, the correlation coefficient is 0.36, which represents a moderate correlation. Only 36% of gentrification values can be tied to redlining alone.

VII. Discussion #1: Lingering Legacy and Public Policies

(Above) Historical redlining vs violence and disadvantage via City Controller.

Even though the federal government’s Civil Rights Act of 1964 and the Fair Housing Act of 1968 banned housing discrimination, the legacy of redlining continues. [9]

Redlined Census Tracts have higher levels of disadvantage, and were “reverse redlined” – targeted for sub-prime mortgages during the Great Recession in 2007-2009. Redlined Census Tracts have also seen higher rates of homicides (nearly half, 152 out of 357, were in Census Tracts labeled “Hazardous”). Redlined Census Tracts even have less tree cover, compared to non-redlined Census Tracts.

Targeted government support could help homeowners and renters to remain in their neighborhoods, and prevent them from losing qualitative ties to their neighbors and groups.

More public-private investment in redlined neighborhoods could also increase their livability, and drive investment across more neighborhoods.

VII. Discussion #2: Neighborhood Racial Segregation

While beyond the scope of this project, there are stark racial differences driven by redlining. In 1930, the African-American population was only 11%. [8] Now, Philadelphia’s racial makeup is 62% non-White, 36% White, and 2% Other.

Gentrified Census Tracts are majority White (57% for not redlined, 50% for redlined). But not gentrified Census Tracts are majority non-White (66% in redlined, 64% in not redlined).

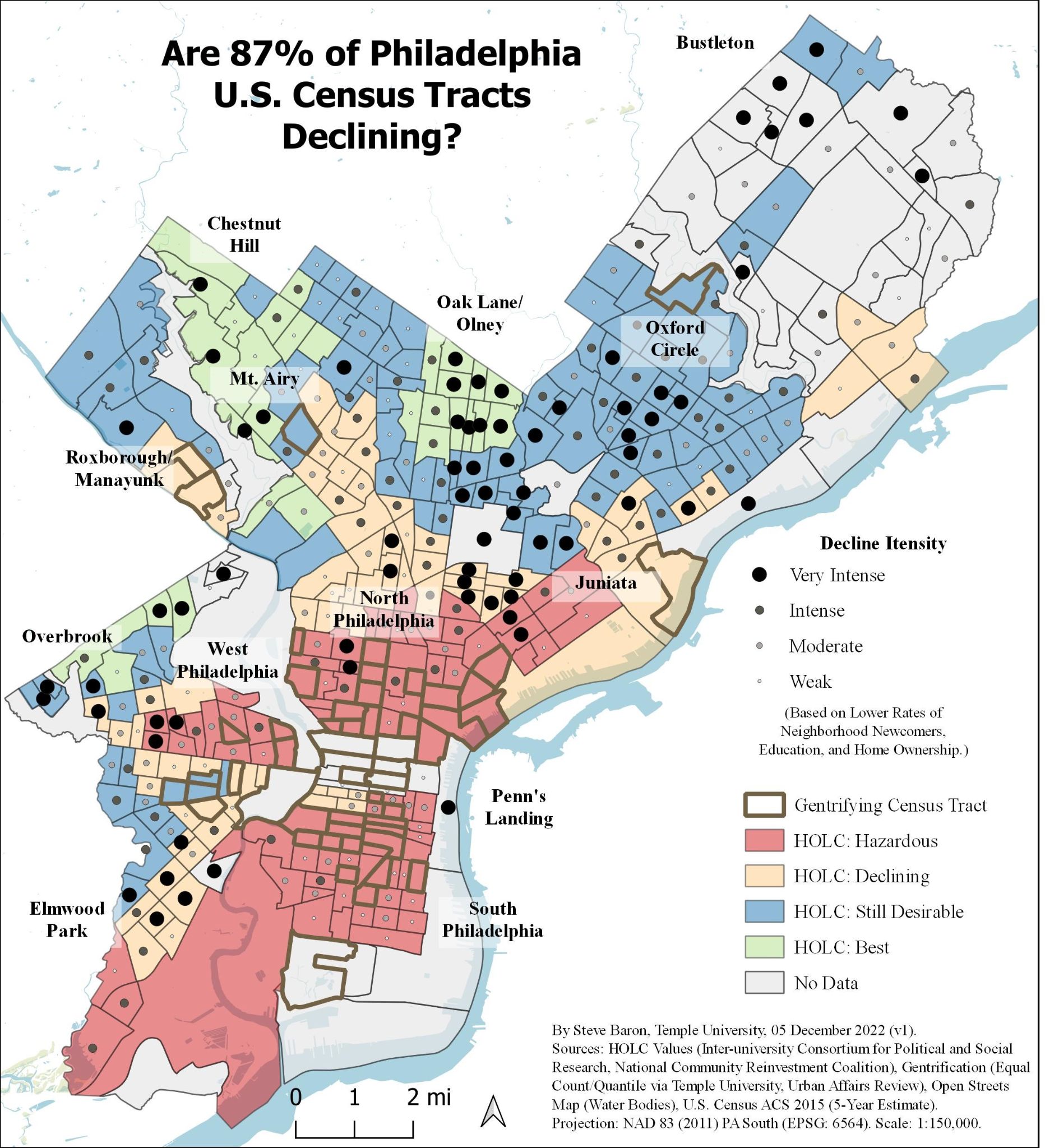

VII. Discussion #3: Declining Neighborhoods

Did this research report miss the bigger picture of Philadelphia’s declining neighborhoods?

An earlier Pew study that analyzed gentrification from 2000 – 2014 found that there were 10x as many Census Tracts (164) that lost income compared to Census Tracts that gentrified (15). [10]

In mapping the reverse of this Gentrification Index – decreasing rates of neighborhood newcomers, home ownership, and education – nearly all (87%) of the city’s Census Tracts (292 of 384) have negative gentrification values. Some scholars call it “slumification.” [11]

This reveals an odd mix of neighborhoods: mostly upper middle class neighborhoods that were labeled “Best” such as Chestnut Hill, Mt. Airy, Oak Lane, Olney, and Oxford Circle, all of which are thriving.

But there are also the lower-middle class neighborhood of Overbrook, which was labeled “Best,” but has declined since, and lower-income Southwest Philadelphia.

More research is needed on what is driving neighborhood decline, the metrics to measure it, and the policies that could reverse decline.

VIII. Works Cited (in chronological order)

[1] “10 Trends That Have Changed Philadelphia in 10 Years.” Pew Trusts. 11 April 2019.

[2] Sutton, Stacey, “Gentrification and the Increasing Significance of Racial Transition in New York City 1970-2010.” Urban Affairs Review: Volume 56, Issue 1, 2018.

[3] Cohen, Amy. “Repercussions of Racist Maps Still Impact Neighborhoods Today.” Hidden City Philadelphia. 16 December 2021.

[4] Hwang, Jackelyn & Ding, Lei. “Unequal Displacement: Gentrification, Racial Stratification, and Residential Destinations in Philadelphia.” American Journal of Sociology, 2020, 126:2, 354-406.

[5] Brummet, Quentin and Reed, David. “The Effects of Gentrification on the Well-Being and Opportunity of Original Resident Adults and Children.” Federal Reserve Bank of Philadelphia, WP-1930, July 2019.

[6] Meier, Helen C.S., and Mitchell, Bruce C. “Historic Redlining Scores for 2010 and 2020 US Census Tracts.” Ann Arbor, MI: Inter-university Consortium for Political and Social Research, 26 May 2021.

[7] “U.S. Census: ACS 2015 (5-Year Estimates).” Social Explorer.

[8] Finkel, Ken. “Roots of Hypersegregation in Philadelphia, 1920-1930.” The Philly History Blog, Philadelphia City Archives. 22 February 2016.

[9] Rynhart, Rebecca. “Mapping the Legacy of Structural Racism in Philadelphia.” Office of the Controller, City of Philadelphia. 23 January 2020.

[10] Bowen-Gaddy, Evan. “3 Maps That Explain Gentrification in Philadelphia.” WHYY. 14 March 2018.

[11] Azhar, A., Buttrey, H., & Ward, P. M. (2021) “Slumification” of Consolidated Informal Settlements: A Largely Unseen Challenge. Current Urban Studies, 9, 315-342. doi: 10.4236/cus.2021.93020.

IX. Additional Resources

[12] Ammon, Francesca. “RESISTING GENTRIFICATION AMID HISTORIC PRESERVATION: Society Hill, Philadelphia, and the Fight for Low-Income Housing.” Change Over Time, 8(1), 8-31,131.

[13] Ding, Lei, Hwang, Jackelyn, Divringi, Eileen. “Gentrification and Residential Mobility in Philadelphia.” Regional Science and Urban Economics, 2016, Vol.61, p.38-51.

[14] Mitchell, Bruce C. and Franco, Juan. “HOLC “Redlining” Maps: The Persistent Structure Of Segregation And Economic Inequality.” National Community Reinvestment Coalition. February 2018.

[15] Mitchell, Bruce C. and Franco, Juan. “HOLC “Redlining” Maps: The Persistent Structure Of Segregation And Economic Inequality.” National Community Reinvestment Coalition. 20 March 2018. https://ncrc.org/holc/

[16] Mitchell, Bruce C. and Meier, Helen C.S. “Tracing The Legacy Of Redlining: A New Method For Tracking The Origins Of Housing Segregation.” National Community Reinvestment Coalition. February 2022.